103 Maps

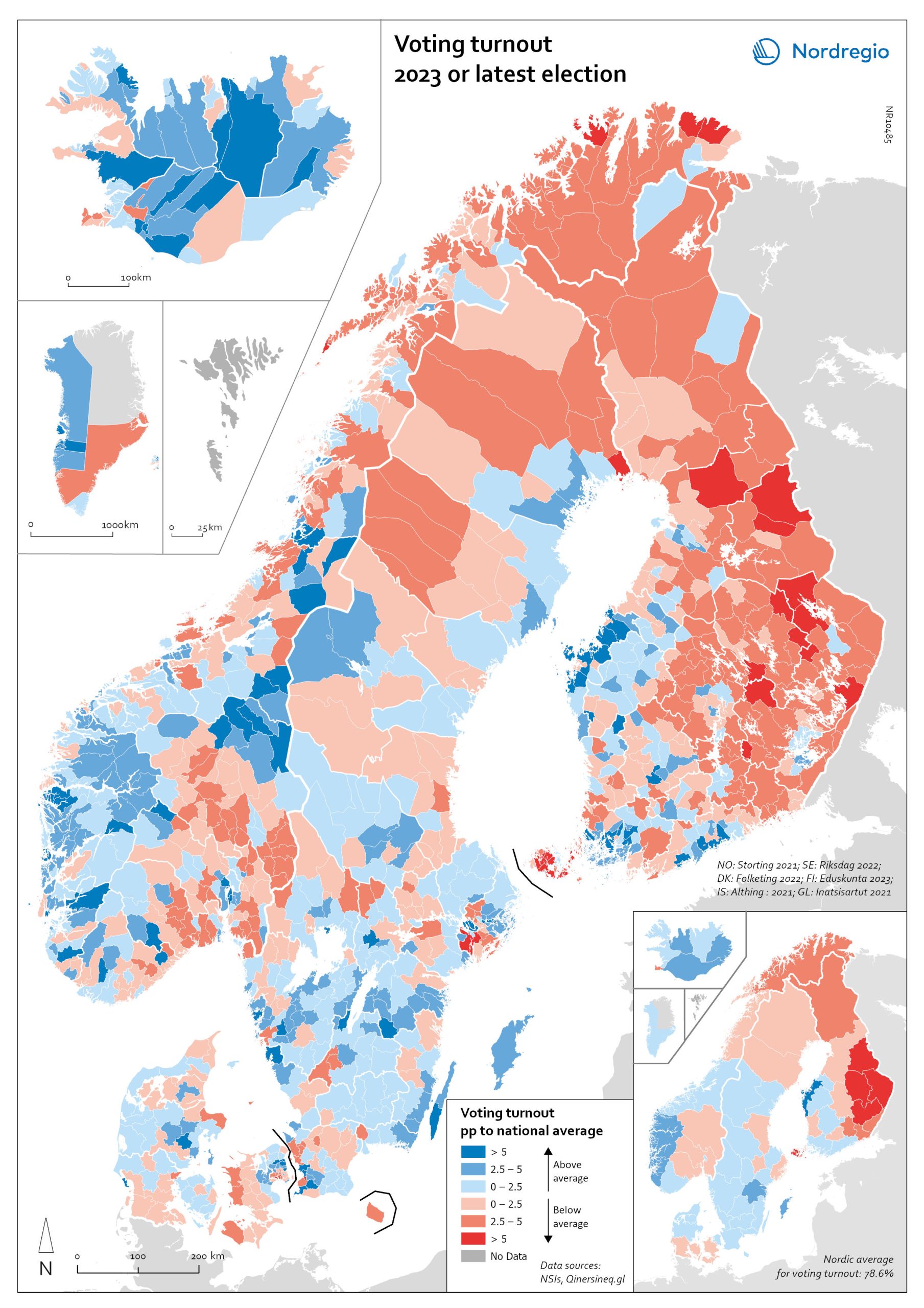

Voting turnout in national elections

Voting turnout in 2023 (or latest national election). The map illustrates voter turnout as a percentage point relative to national averages, highlighting differences in participation levels between countries. This method removes inter-country differences in participation levels, providing a clearer view of the urban-rural divide. Lower turnout is observed in eastern Finland, northern Sweden, and the more rural parts of Denmark. In Norway, the lowest turnout occurs in the north and in municipalities outside Oslo. Nationally, the highest voter turnouts are in the Faroe Islands (88%), Sweden (84.2%), and Denmark (84.16%). Lower participation rates are found in Iceland (80.1%), Norway (77.2%), Finland (68.5%), and Greenland (65.9%).

2024 May

- Nordic Region

- Others

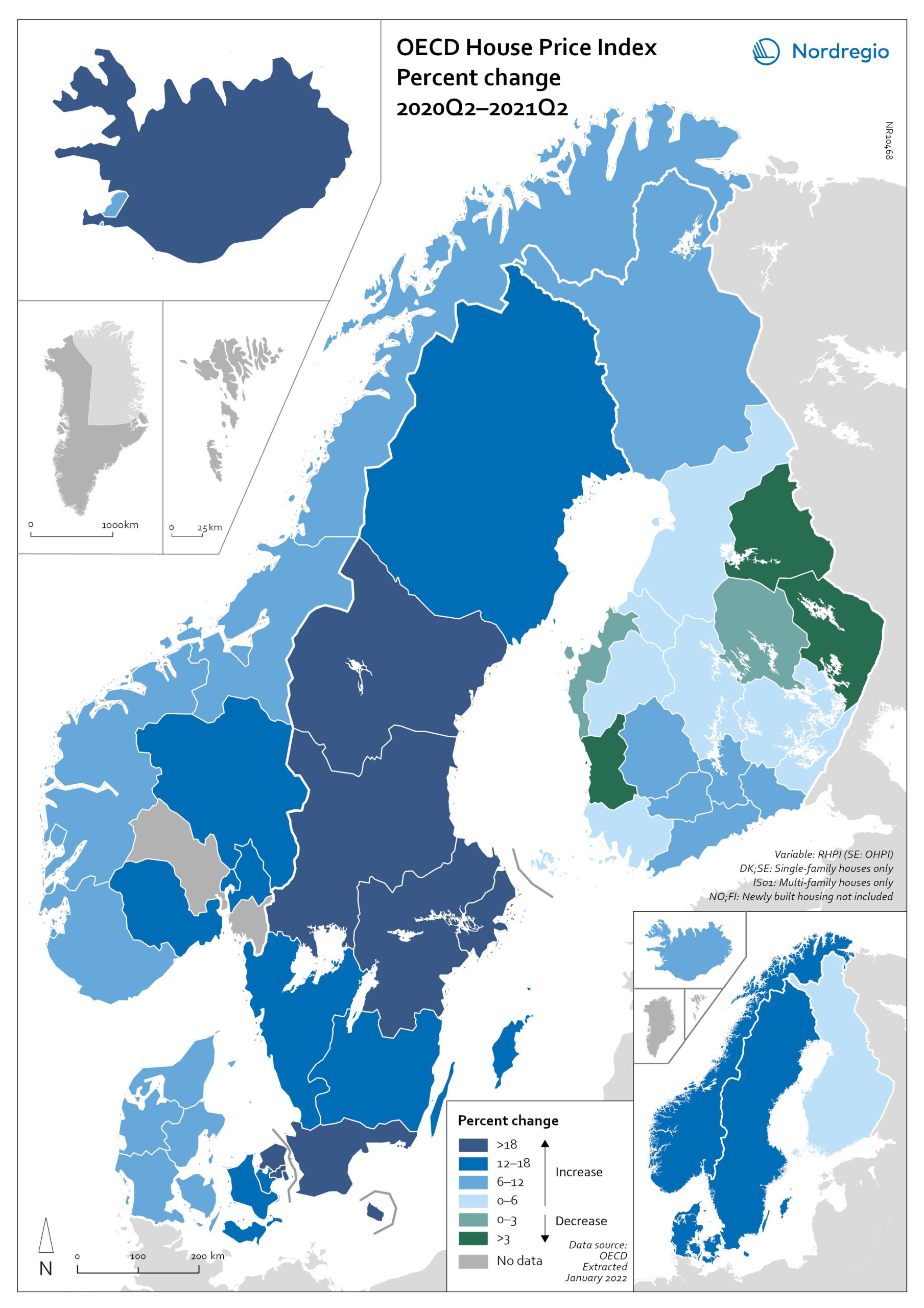

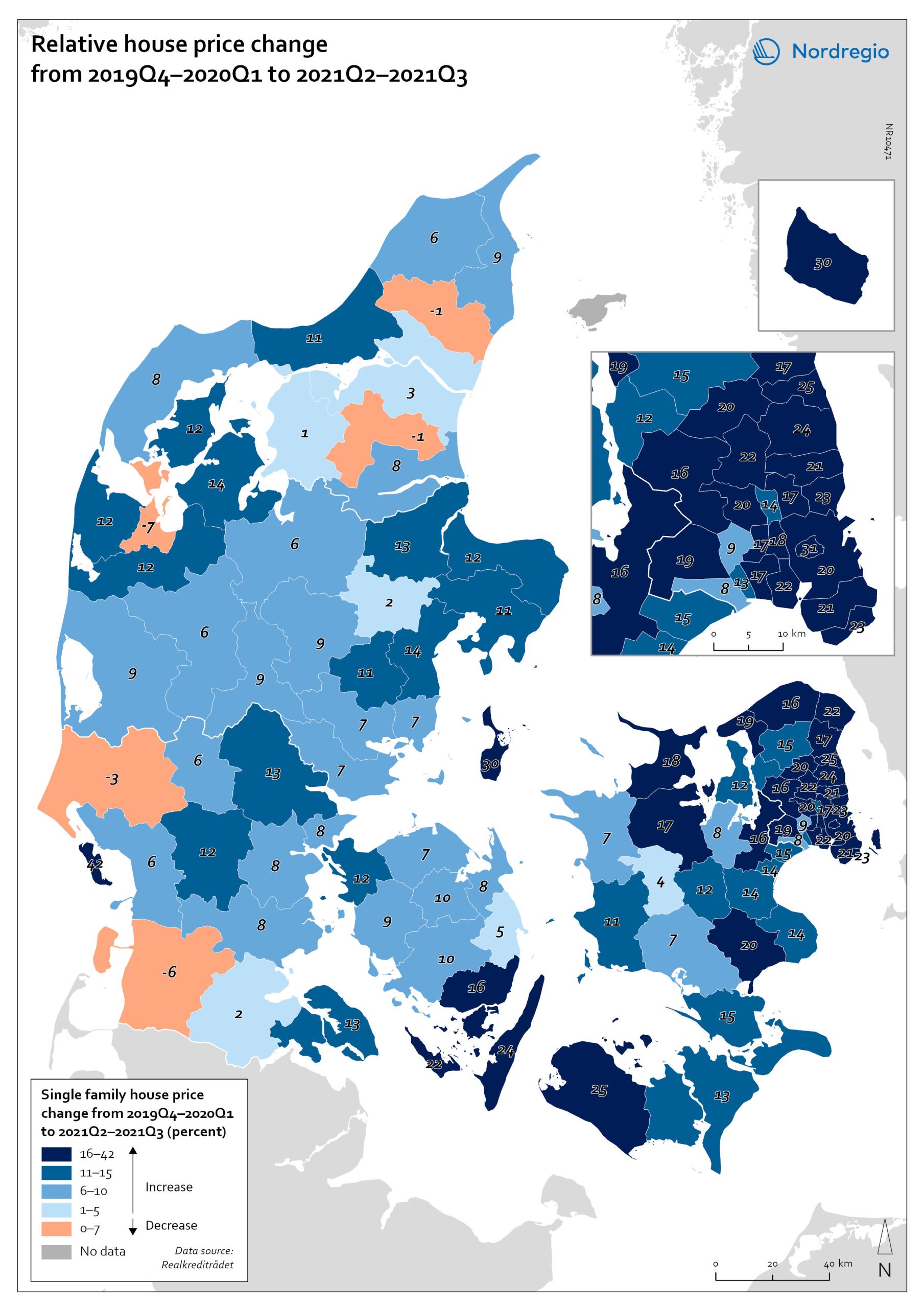

OECD House Price Index. Change 2020Q2–2021Q2

The map shows the relative change of the OECD House Price Index from Q2 2020 to Q2 2021. The map shows that the price development was not uniform within the countries. Iceland recorded the largest price increases overall, with the most marked price increases found outside of the capital region. All Swedish regions recorded increases above 20%, with the highest increases in the Stockholm and Malmö regions. All Norwegian regions showed price increases, though to a lesser extent than Swedish regions in most cases. In Denmark, Bornholm, Sjælland and the rural islands of Lolland and Falster recorded relatively high price increases, although many rural areas developed from low absolute prices in 2020. Finland was the only country where some regions saw property prices decrease. Moderate increases were still observed in some of the southern regions, where the major cities are located, and in the north.

2022 March

- Economy

- Nordic Region

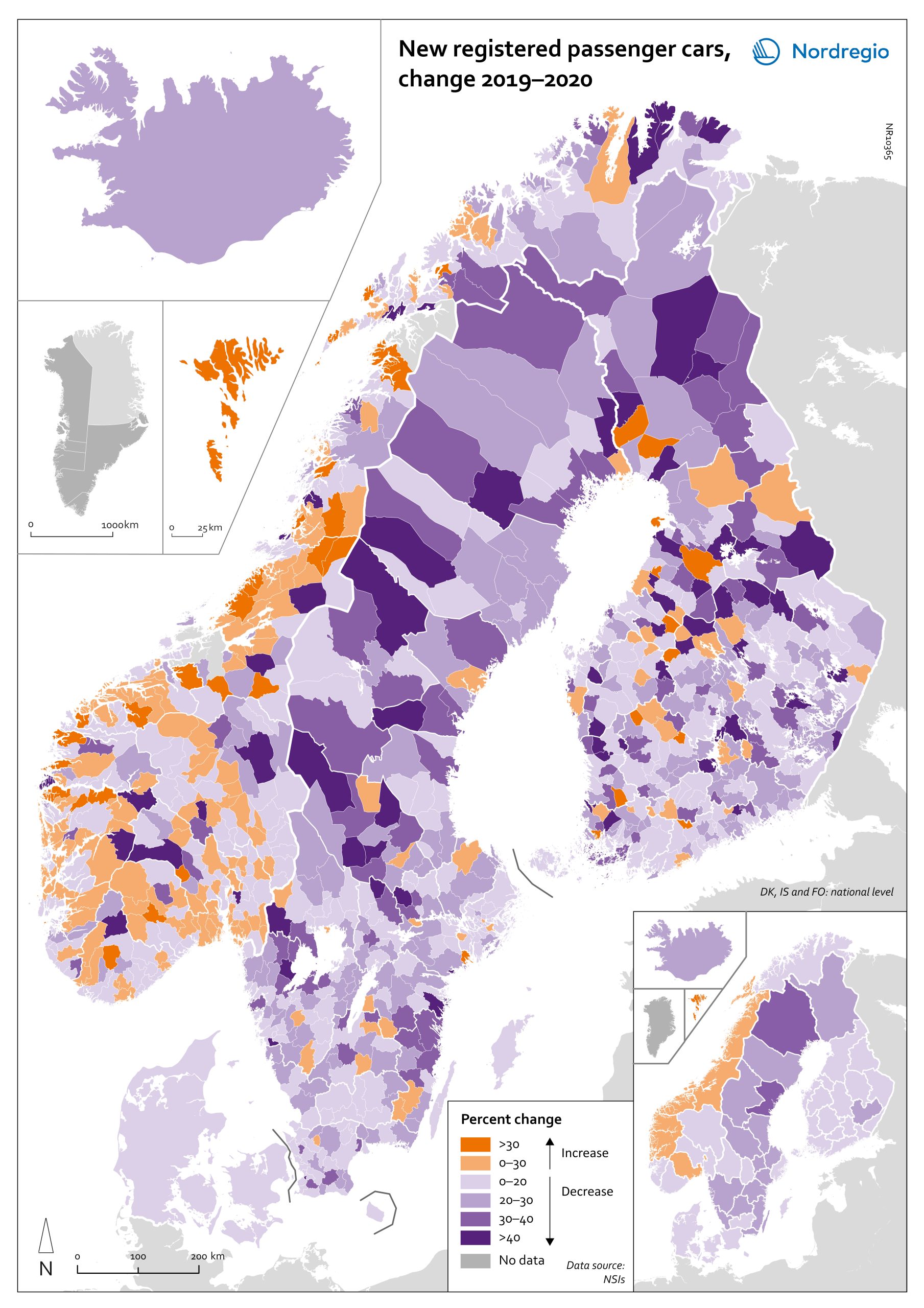

Change in new registered cars 2019-2020

The map shows the change in new registered passenger cars from 2019 to 2020. In most countries, the number of car registrations fell in 2020 compared to 2019. On a global scale, it is estimated that sales of motor vehicles fell by 14%. In the EU, passenger car registrations during the first three quarters of 2020 dropped by 28.8%. The recovery of consumption during Q4 2020 brought the total contraction for the year down to 23.7%, or 3 million fewer cars sold than in 2019. In the Nordic countries, consumer behaviour was consistent overall with the EU and the rest of the world. However, Iceland, Sweden, Finland, Åland, and Denmark recorded falls of 22%–11% – a far more severe decline than Norway, where the market only fell by 2.0%. The Faroe Islands was the only Nordic country to record more car registrations, up 15.8% in 2020 compared to 2019. In Finland, Iceland, Norway, and Sweden, there were differences in car registrations in different parts of the country. In Sweden and Finland, the position was more or less the same in the whole of the country, with only a few municipalities sticking out. In Finland and Sweden, net increases in car registrations were concentrated in rural areas, while in major urban areas, such as Uusimaa-Nyland in Finland and Västra Götaland and Stockholm in Sweden, car sales fell between 10%–22%. Net increases in Norway were recorded in many municipalities throughout the whole country in 2020 compared to 2019.

2022 March

- Economy

- Nordic Region

- Transport

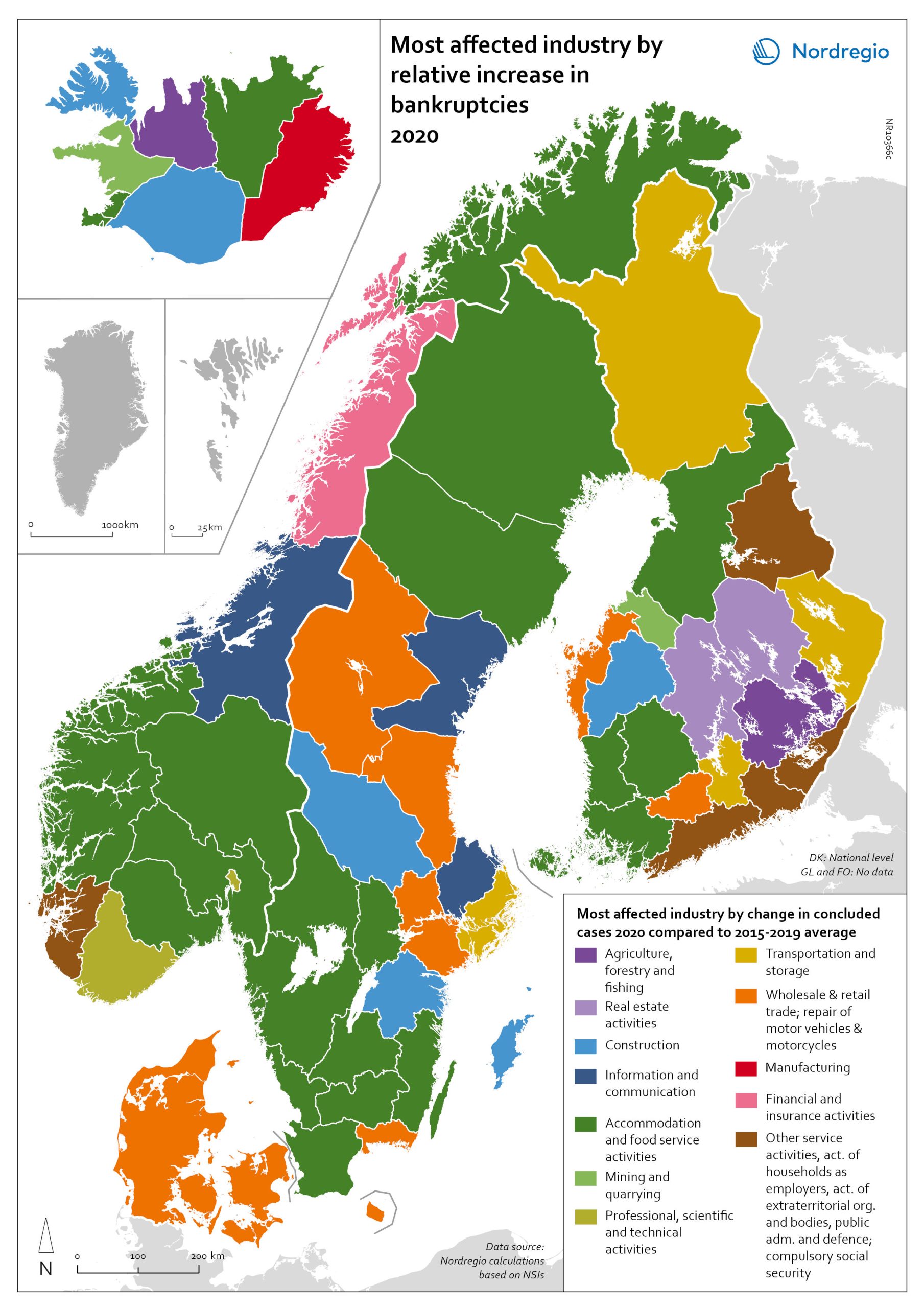

Bankruptcies in 2020 by industry and region

The map shows the most affected industry by relative increase in concluded business bankruptcies 2020 compared to 2015–2019 average. Regional patterns in business failures are linked to factors ranging from the effectiveness of the measures adopted by the various governments to the exposure of regional economies to vulnerable sectors. Regions with higher numbers of bankruptcies tend to reflect the concentration of economic activity in sectors particularly affected by the pandemic. It comes as little surprise that Accommodation and food service activities were the industries with the largest increase in business bankruptcies in 2020 compared to the 2015–2019 baseline. In the Nordic Region as a whole, the number rose by 28.6%. This pattern is also discernible at the regional level. Hotels and restaurants were the activities with the biggest increase in the number of bankruptcies in a significant number of Swedish, Norwegian and Finnish regions. Other sectors suffering higher-than-average numbers of business bankruptcies are service industries, particularly those requiring closer social interaction, like Education (16.5% increase), Other service activities (12.0% increase) and Administrative and support service activities (7.9% increase). The logistics sector was also greatly affected, with major impact localised around logistics centres and transport nodes in the different countries. In the capital regions of Oslo, Stockholm and Helsinki, Transportation and storage was the sector with the largest increase in bankruptcies. Wholesale and retail trade; repair of motor vehicles and motorcycles was the industry to suffer the most in Denmark and several Finnish and Swedish regions.

2022 March

- Economy

- Nordic Region

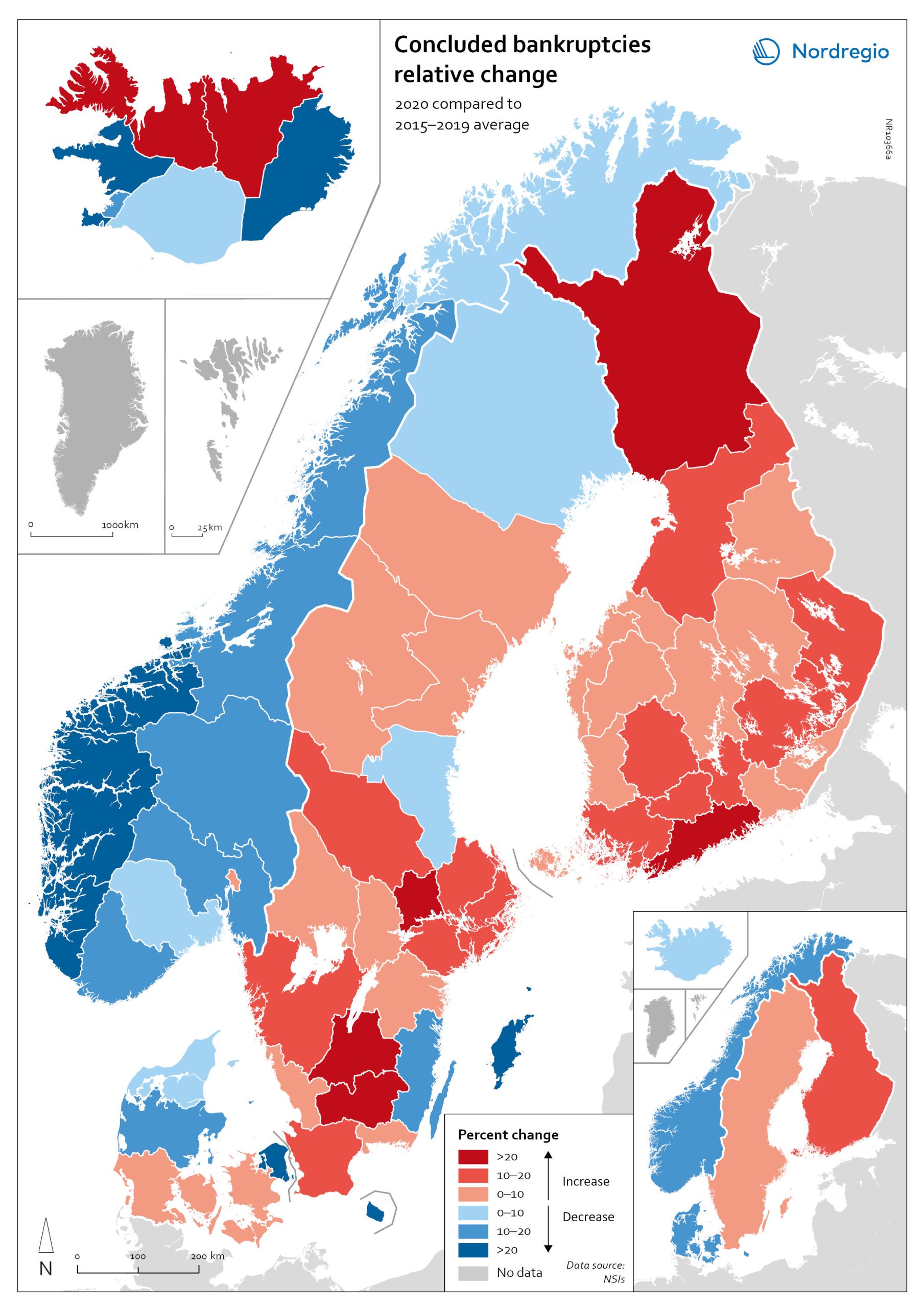

Relative change in the number of business bankruptcies

The map shows the relative change in the number of concluded business bankruptcies by region, 2015–2019 average compared to 2020. At sub-national levels, the distribution of business bankruptcies does not show a clear territorial pattern. In Iceland and Denmark, businesses in the most urbanised areas, including the capital regions, seem to have been those that benefited most from the economic mitigation measures (-23.9% in Höfuðborgarsvæðið and -24.4% in Region Hovedstaden). By contrast, Oslo is the only Norwegian region where there were more business bankruptcies in 2020 compared to the 2015–2019 baseline (1.9% increase). Most Norwegian regions did, in fact, have fewer bankruptcies in 2020, particularly in the western regions. One plausible explanation for this could be that the number of business failures during the baseline period was especially high in western Norway due to the fall in oil prices in 2014–2015. In Sweden the situation is even more mixed. Here, businesses in urban areas seem to have been more exposed to the distress caused by the Covid-19 pandemic. The most urbanised regions in the Stockholm-Gothenburg-Malmö corridor registered a greater increase in liquidations (Jönköping, Kronoberg and Södermanland regions saw surges of around 20%). However, predominantly rural regions in Sweden, such as Västerbotten and Jämtland, also recorded higher numbers of bankruptcies than average (9.8% and 8.8% increase, respectively). In Finland, the impact was greater in Lapland (26.9%) and around Helsinki (Uusimaa, 25.9%) than in the central parts of the country. Åland also experienced a moderate rise in business bankruptcies in 2020 (4.0%), mostly related to the tourism sector.

2022 March

- Economy

- Nordic Region

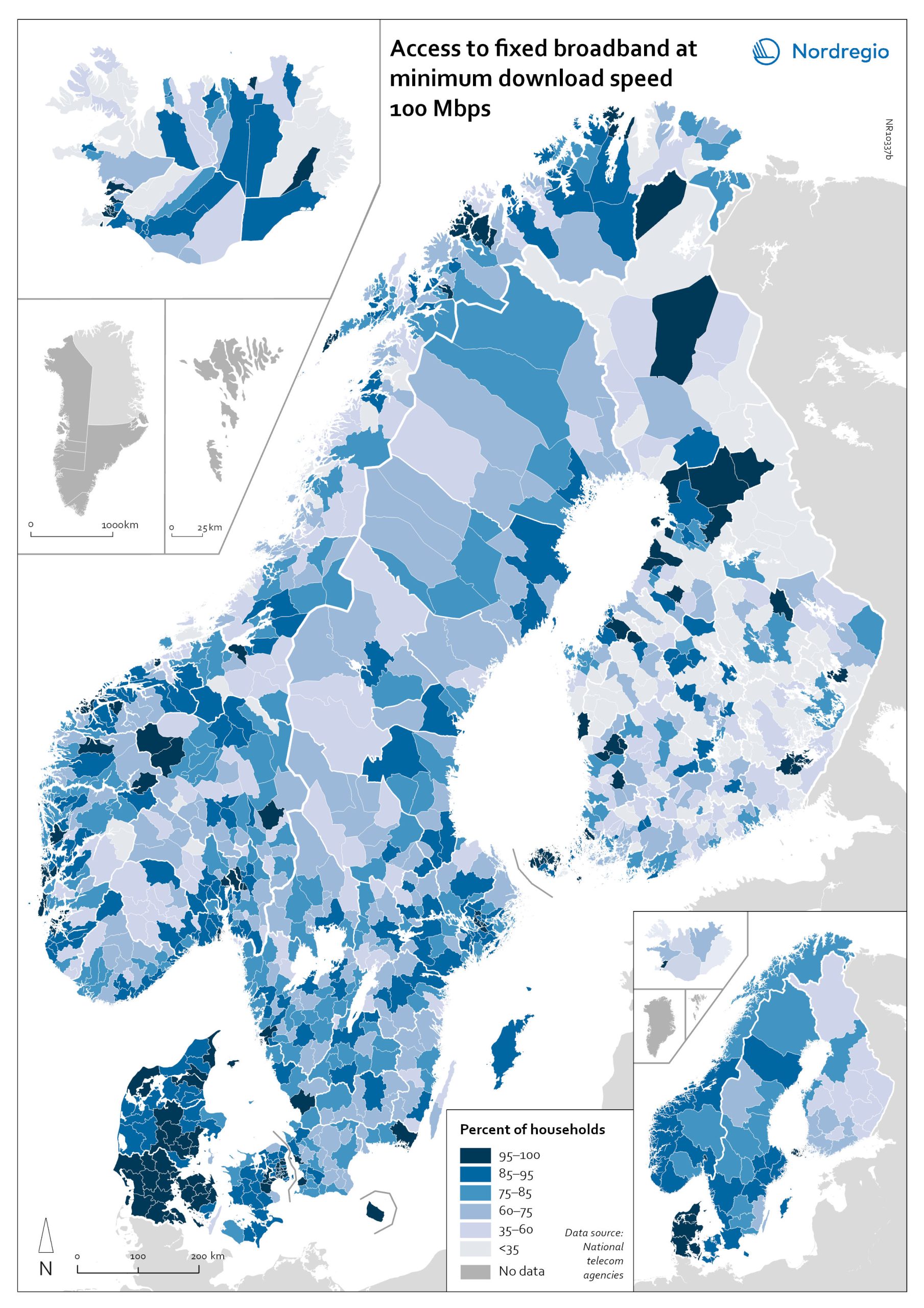

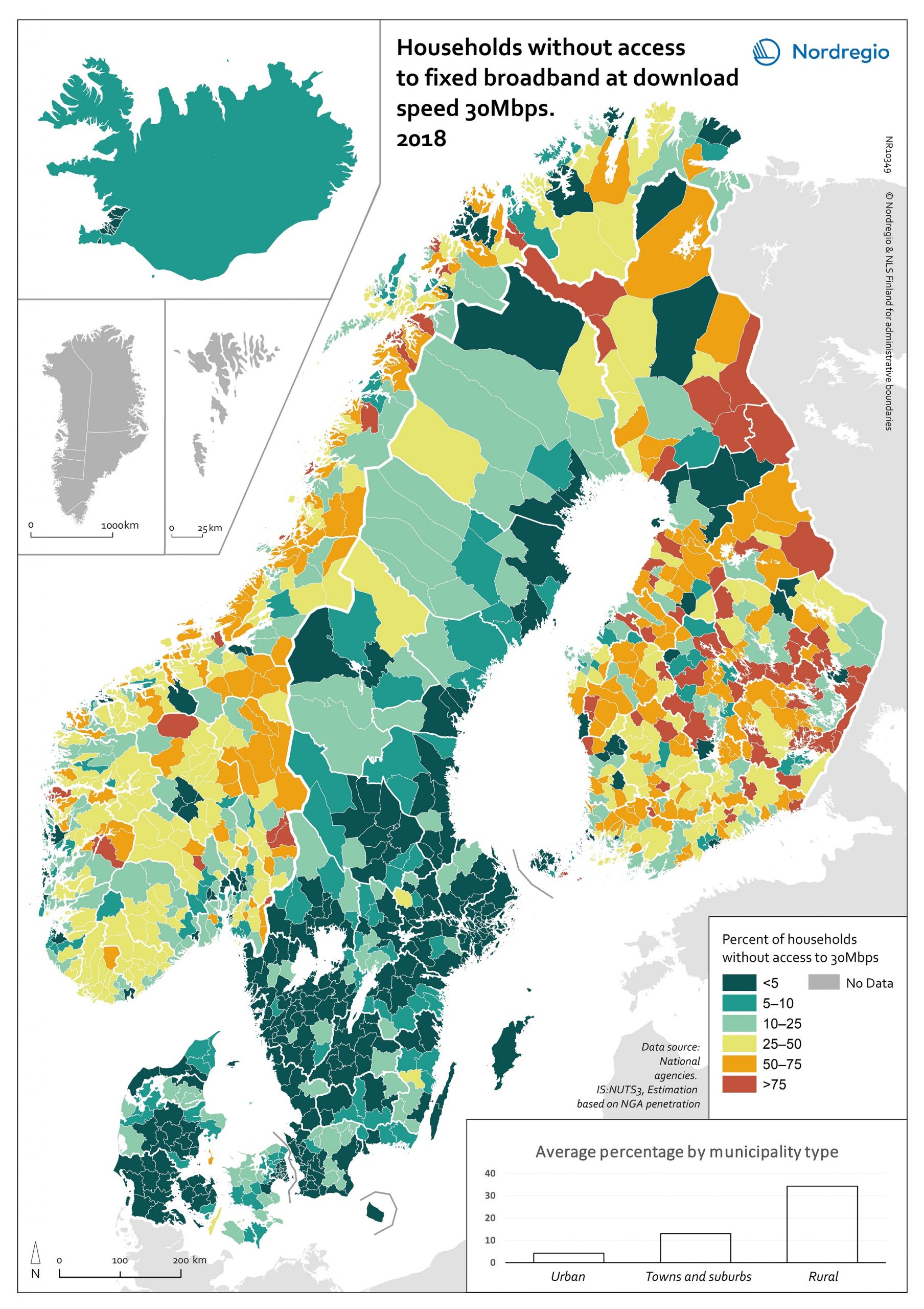

Access to fixed broadband at minimum download speed 100 Mpbs

The map shows the proportion of households that had access to fixed-line broadband with download speeds >100 Mbps (superfast broadband) at the municipal level, with darker colours indicating higher coverage. Overall, Denmark has the highest levels of connectivity, with 92% of municipalities providing superfast broadband to at least 85% of households. In over half (59%) of all Danish municipalities, almost all (>95%) of households have access to this connection speed. The lowest levels of connectivity are found in Finland. This is particularly evident in rural municipalities where, on average, less than half of households (48%) have access to superfast broadband. Connectivity levels are also rather low in some parts of Iceland, for example, the Westfjords and several municipalities in the east. Households in urban municipalities are still more likely to have access to superfast broadband than households in rural or intermediate municipalities, but the gap appears to be closing in most. This is most evident in Norway, where the average household coverage for rural municipalities increased by 31% between 2018 and 2020. By comparison, average household coverage for urban municipalities in Norway increased by only 0.7%. In the archipelago (Åland Islands, Stockholm and Helsinki), general broadband connectivity is good; however, some islands with many second homes still have poor coverage.

2022 March

- Labour force

- Nordic Region

- Others

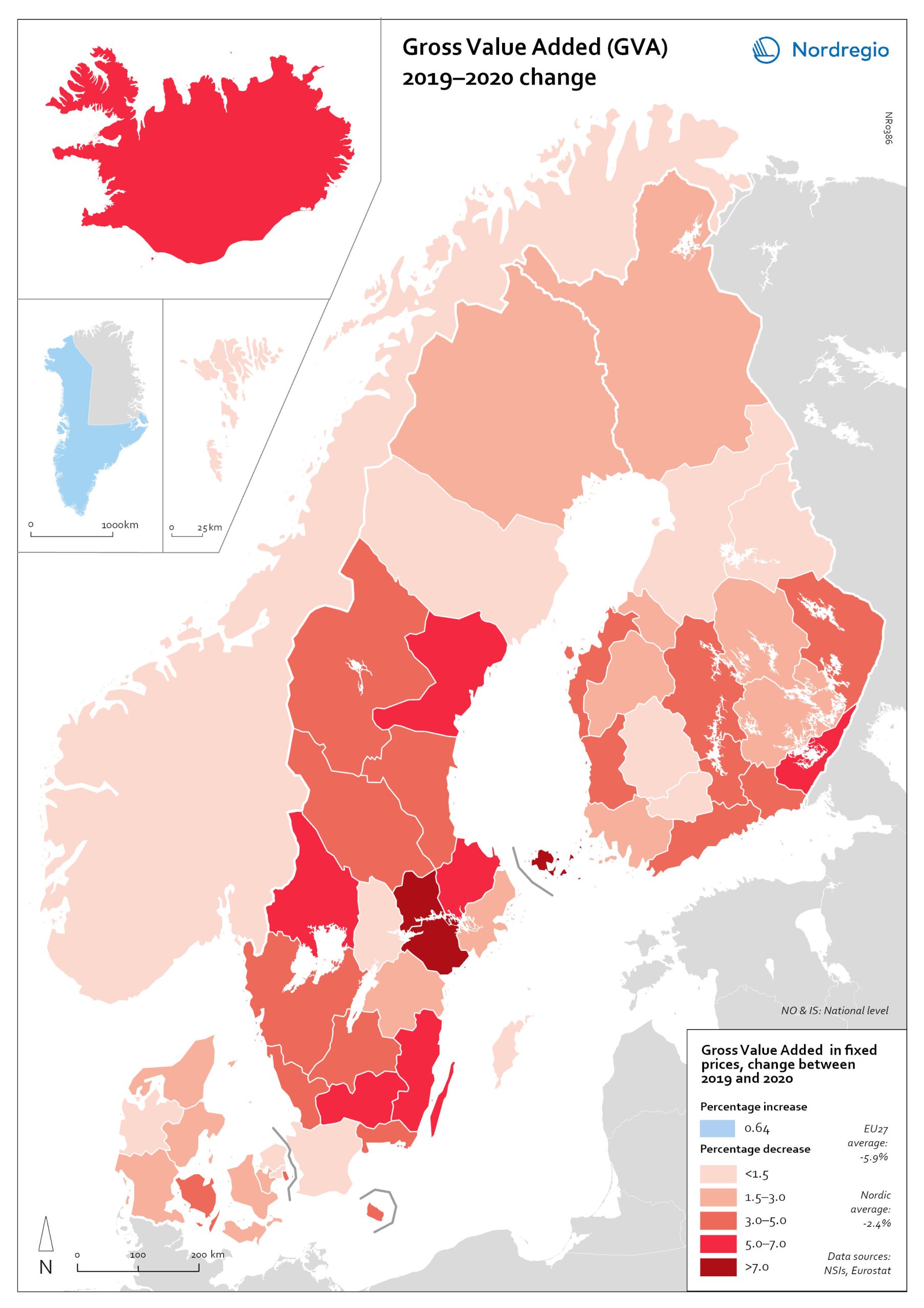

Gross Value Added (GVA) change 2019-2020

The map shows the change in regional Gross Value Added (GVA) from 2019 to 2020 (in fixed prices). As shown in the map, aggregated production levels, in terms of Gross Value Added (GVA), contracted in nearly all of the Nordic regions between 2019 and 2020. In general, the variability was comparatively smaller within each country than it was between countries, even when comparing regions with similar economic profiles from different countries. On average, the impact was greater on regions in Sweden and Finland than those in Denmark. Still, some relevant territorial patterns emerge from the changes to regional GVA shown in the map. The contraction was larger in regions with higher dependence on tourism services and hospitality (Åland and some municipalities in South Karelia, Finland, and Bornholm, Denmark), as well as on mass-market retail and logistics, particularly in the areas surrounding the capital regions (Södermanland and Västmanland in Sweden and Greater Copenhagen in Denmark). In Sweden and Finland, a remarkable regional divide can also be traced between territories specialised in transformation sectors with limited vulnerability to the impact of Covid-19, including forestry and specific types of processing (e.g. pulp, cement), like Nord Ostrobothnia, Kainuu and Pirkanmaa in Finland, and Gotland, Västerbotten and Örebro in Sweden. Aggregated output in these regions fell less than in regions with greater exposure to industrial manufacturing, like Kymenlaakso in Finland and Kronobergs in Sweden. Similarly, the impact on the financial centres in Denmark (Greater Copenhagen) and Sweden (Stockholm) was less than regions with mid-sized cities and diversified urban economies, like Vestjylland (Århus) in Denmark and Upsala in Sweden. Interestingly, the shock to the Finnish economy was greater in the Helsinki metropolitan area (-3.6% Uusimaa) than it was for the Tampere region (-0.5% in Pirkanmaa). This may be due to the relatively higher concentration…

2022 March

- Economy

- Nordic Region

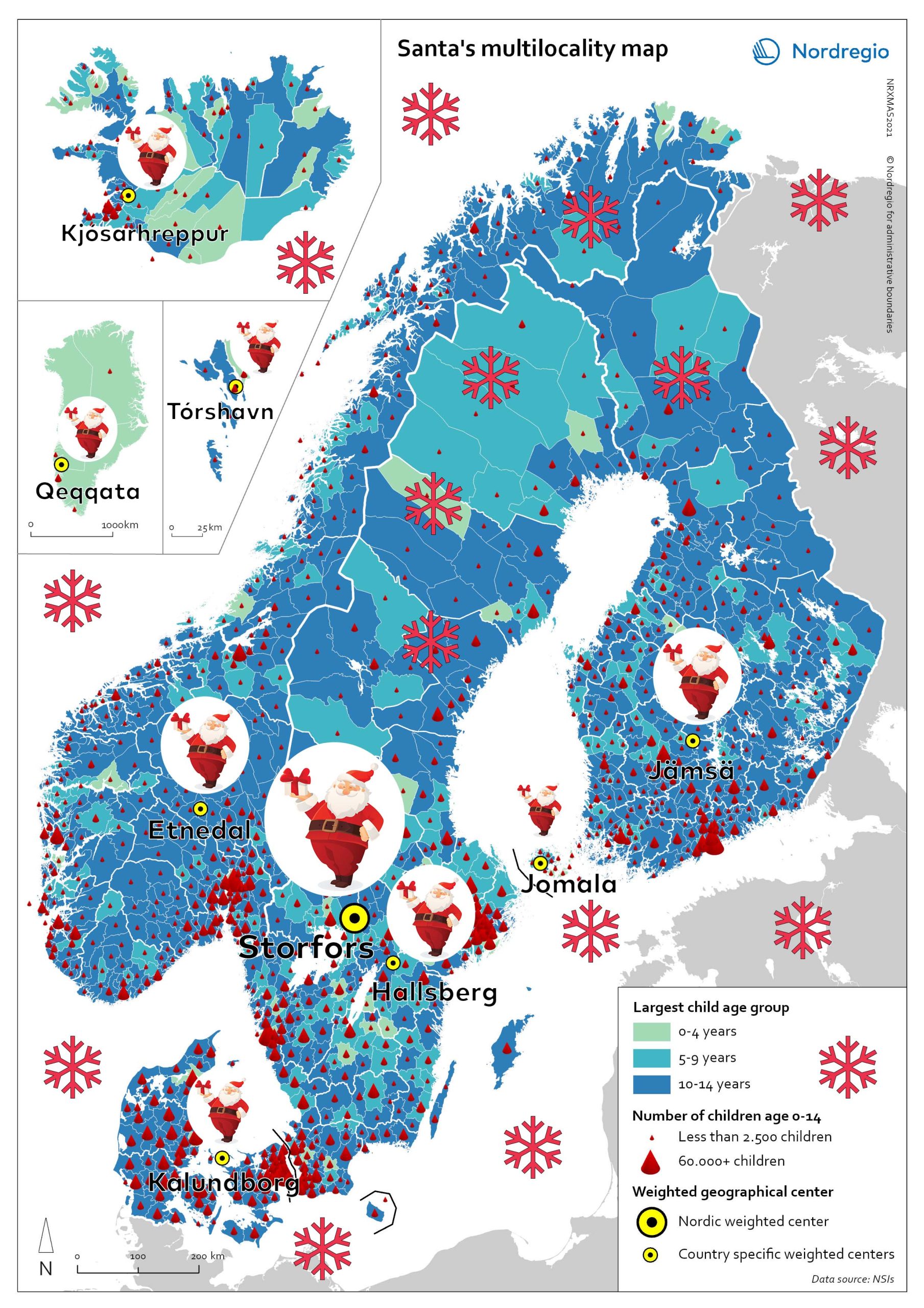

Help Santa to work remotely – where to locate in 2021?

Help Santa! To reduce his transit times and emissions – reindeers burn a lot of (green) fuel – and find an optimal remote workplace from where to deliver gifts to all the children in the Nordic Region! Santa has heard about this new trend “multilocational lifestyle” and he would like to know if this would suit him as well. But where to move? Santa’s little researchers have worked hard this year and done some mapping for him – and discovered places you have never even heard of! If Santa is to serve all children (0-14 years old) throughout the Nordic Region from a single address, the solution lies in Storfors Municipality. WHERE? – you might think. It is a real place, in Central-Southern Sweden. Here Santa has an average distance of 425 km distance to each child from his own backyard. This still sounds like awfully many kilometers. Could he be even more multilocal – with a home in each of the Nordic countries? This would help him to reduce his overall commuting to work significantly. Let’s try it! If he serves all 4.974 children in Åland from a residence (like a luxury hotel with all-inclusive and pets allowed) in Jomala Municipality, he will only have to travel 11 km to work on average. In Greenland, the distances are somewhat larger, and Santa, even with the most optimal location from a residence (a cabin) in Qeqqata Municipality would have to travel 288 km to each of the 11,748 children in the country. Can you guess what the other optimal locations would be in the Nordics? I bet you can’t so I will tell you: it’s the municipalities of Hallsberg in Sweden, Jämsä in Finland, Etnedal in Norway, Kalundborg in Denmark, Kjósarhreppur in Iceland and Tórshavn in Faroe Islands. Well, Santa…

2021 December

- Nordic Region

- Others

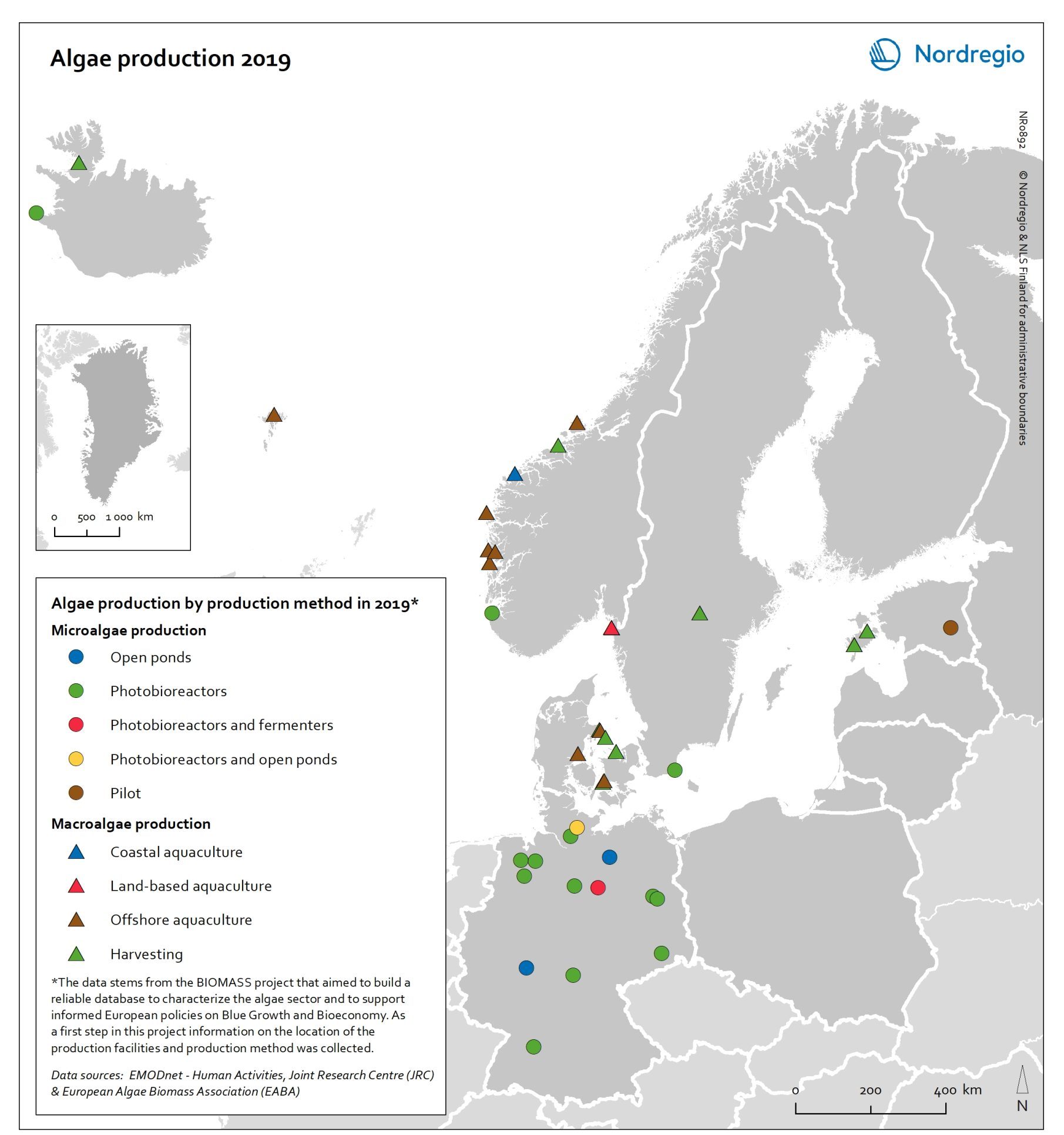

Algae production in 2019

This map shows location of algae production by production method in the Nordic Arctic and Baltic Sea Region in 2019 Algae and seaweeds are gaining attention as useful inputs for industries as diverse as energy and human food production. Aquatic vegetation – both in the seas and in freshwater – can grow at several times the pace of terrestrial plants, and the high natural oil content of some algae makes them ideal for producing a variety of products, from cosmetic oils to biofuels. At the same time, algae farming has added value in potential synergies with farming on land, as algae farms utilise nutrient run-off and reduce eutrophication. In addition, aquatic vegetation is a highly versatile feedstock. Algae and seaweed thrive in challenging and varied conditions and can be transformed into products ranging from fuel, feeds, fertiliser, and chemicals, to third-generation sugar and biomass. These benefits are the basis for seaweed and algae emerging as one of the most important bioeconomy trends in the Nordic Arctic and Baltic Sea region. The production of algae for food and industrial uses has hence significant potential, particularly in terms of environmental impact, but it is still at an early stage. The production of algae (both micro- and macroalgae) can take numerous forms, as shown by this map. At least nine different production methods were identified in the region covered in this analysis. A total of 41 production sites were operating in Denmark, Estonia, the Faroe Islands, Iceland, Norway, Germany, and Sweden. Germany has by far the most sites for microalgae production, whereas Denmark and Norway have the most macroalgae sites.

2021 December

- Arctic

- Baltic Sea Region

- Nordic Region

- Others

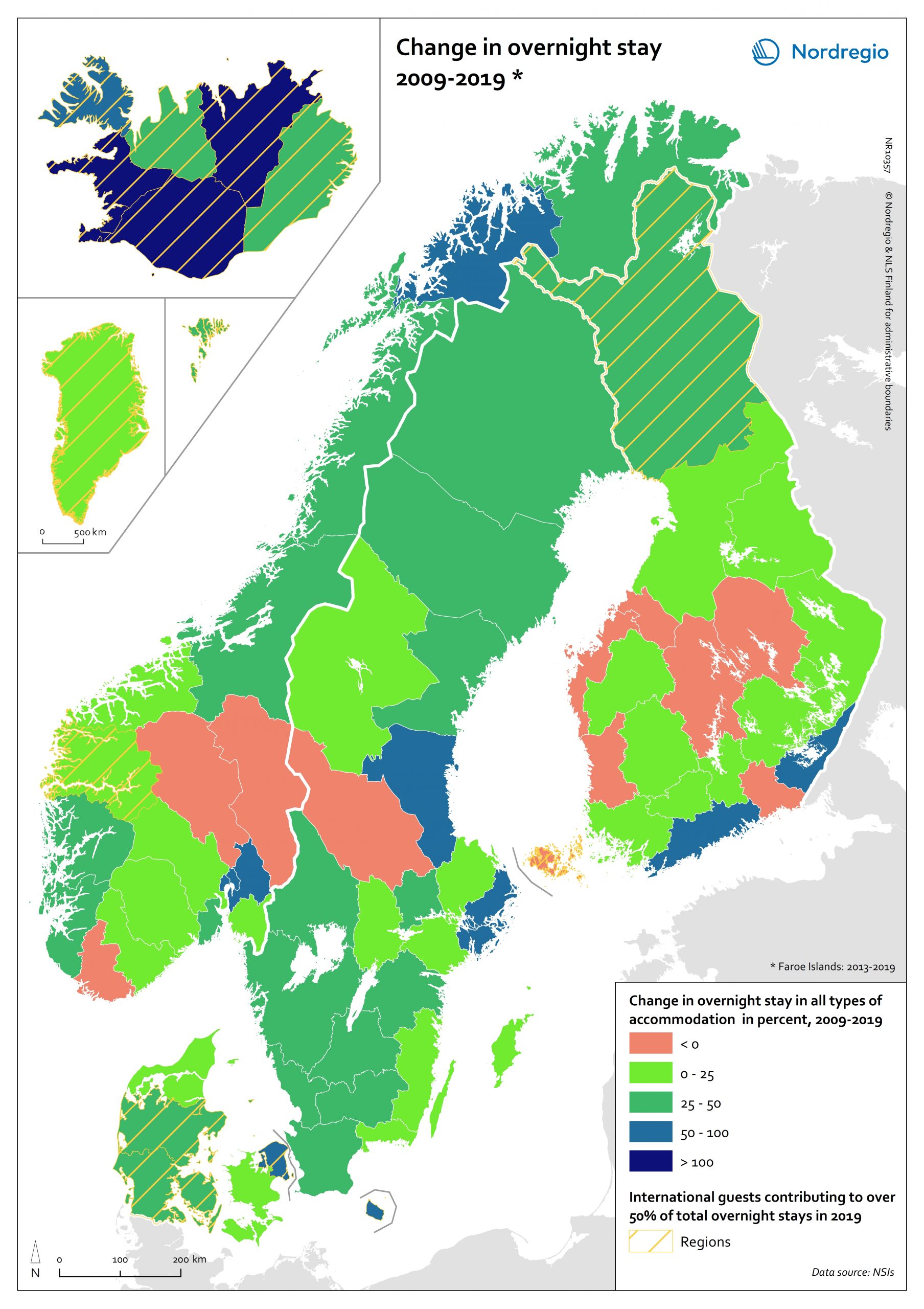

Change in overnight stay 2009-2019

The indicator measures the total overnight stays by guests in all types of accommodation, i.e., hotels and holiday resorts, camping sites, youth hostels, marinas, and holiday cottages. The map shows the change in percent from 2009 and 2019 (Faroe Island: 2013-2019 due to limited data availability). The orange colour indicates a shrink, while bluish colours indicate an increase. Bluer the colour is, larger is the increase. The shaded colour in yellow highlights the regions where international guests contributed to more than half of the total overnight stays in 2019. Most Nordic regions and territories have experienced an increase in the number of overnight stays during the last decade. The most dramatic increase can be observed in Iceland, with 5 of its 8 regions witnessing an increase in overnight stays over 100% between 2009-2019. The overnight stays in Suðurnes have increased by 451% during 2009-2019, being the largest increase in the Nordic Region. It’s also worth noting that the nearly all the regions and territories with more international guests have an increase in the total number of overnight stays, indicating that international tourism is playing a more important role in the Nordic tourism industry. The only exception is Åland, whose overnight stays dropped by 5% during 2009-2019. The traditional skiing destinations in Norway and Sweden have also witnessed a decrease in their total overnight stays, i.e., Hedmark, Oppland and Dalarna. Hedmark, among all the Nordic regions and territories, experienced the largest decline of overnight stays of 15% between 2009-2019. The number of overnight stays in some regions in eastern and central Finland also decreased from 2009 to 2019, e.g., Central Ostrobothnia and Satakunta, with domestic guests as the main tourists.

2021 February

- Nordic Region

- Others

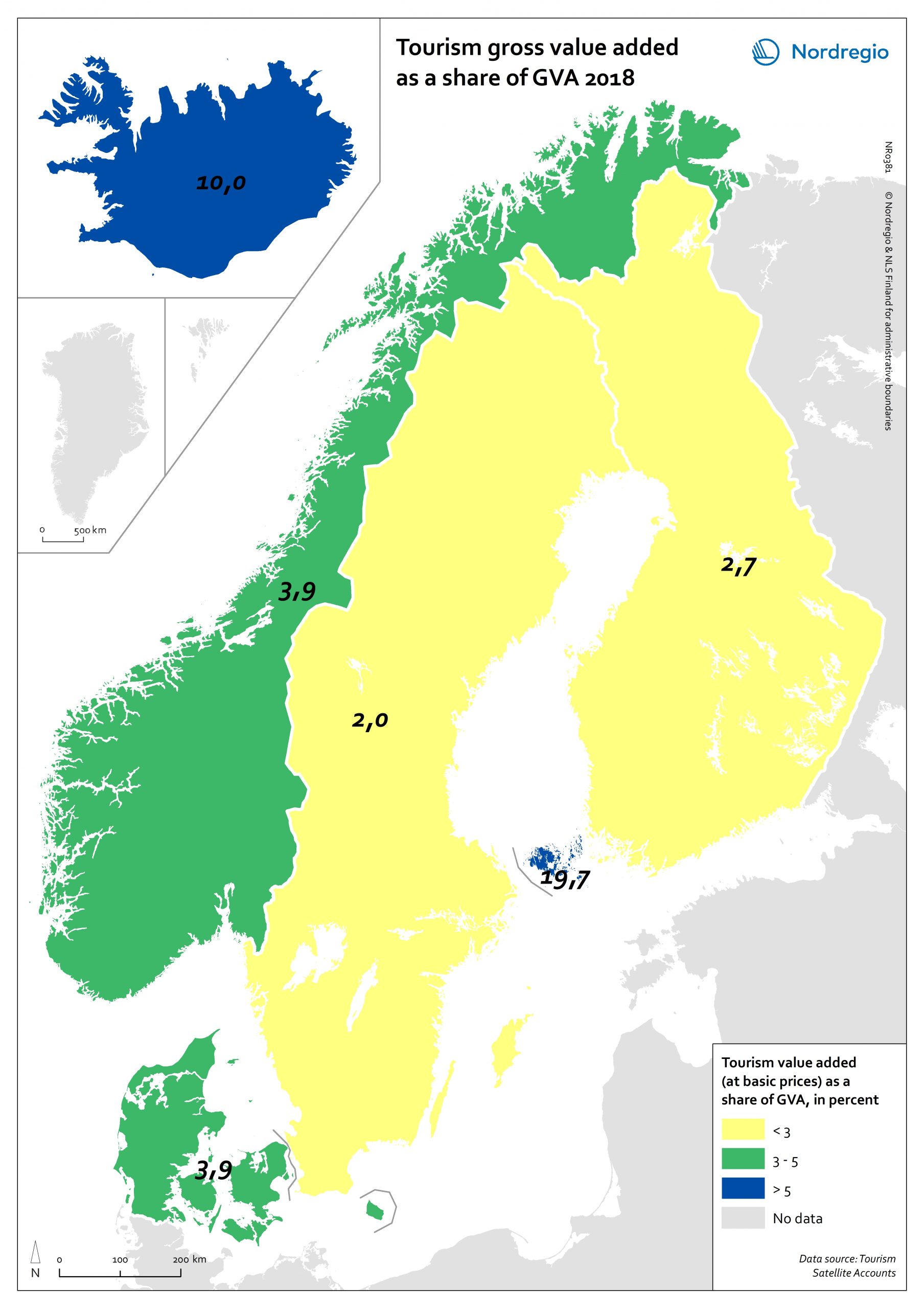

Tourism gross value added as a share of GVA 2018

Tourism gross added value (GVA) corresponds to the part of GVA generated by all industries in contact with visitors. This indicator is measured as a percentage of total GVA at basic prices in 2018 (No data for Greenland and Faroe Islands; data for Finland includes Åland). Data were retrieved from each country’s tourism satellite account. Åland and Iceland stand out as the country or territory where tourism added value accounts for over 10% of the total GVA. For Åland, tourism is so important an industry that added value related to tourism is equivalent to nearly 20% of the total GVA in Åland. The share of tourism related GVA is close to 4% of the total GVA in Norway and Denmark, and lower than 3% in Finland and Sweden.

2021 February

- Economy

- Nordic Region

How to prepare for Home Alone Christmas 2020?

The conditions for a Home Alone Christmas vary greatly across the Nordic Region. The combination of the selected two accessibility indicators is visualised on Nordregio’s Christmas Map 2020. It classifies the Nordic municipalities into nine categories, based on: – The share of households with fixed broadband of at least 30mbps is used to measure the quality and distribution of internet connection. The higher the percentage, the bigger chance you will have an uninterrupted online celebration! – The average distance to grocery stores is used to estimate the time required to get your Christmas food: the closer to a grocery store, the more spontaneous you can be. On one side of the spectrum are about a fourth of the municipalities having a high share of households (>75%) with a decent broadband connection and a short average distance to the closest grocery store (<2,5 km). This enhances last-minute Christmas preparation and high-quality online celebrations. These municipalities are colored in dark purple on the map and are mostly, but not exclusively, located in urban areas in Denmark, Finland, Iceland, Norway and Sweden. On the other side of the spectrum, about 10% of Nordic municipalities have rather weak fixed broadband coverage (<50%) and relatively long travel distances to the closest grocery store (> 5km), requiring more planning for celebrating Christmas. These municipalities are colored in light purple on the map and are mostly found in sparsely population municipalities in Finland and mountainous municipalities in Norway.

2020 December

- Nordic Region

- Others

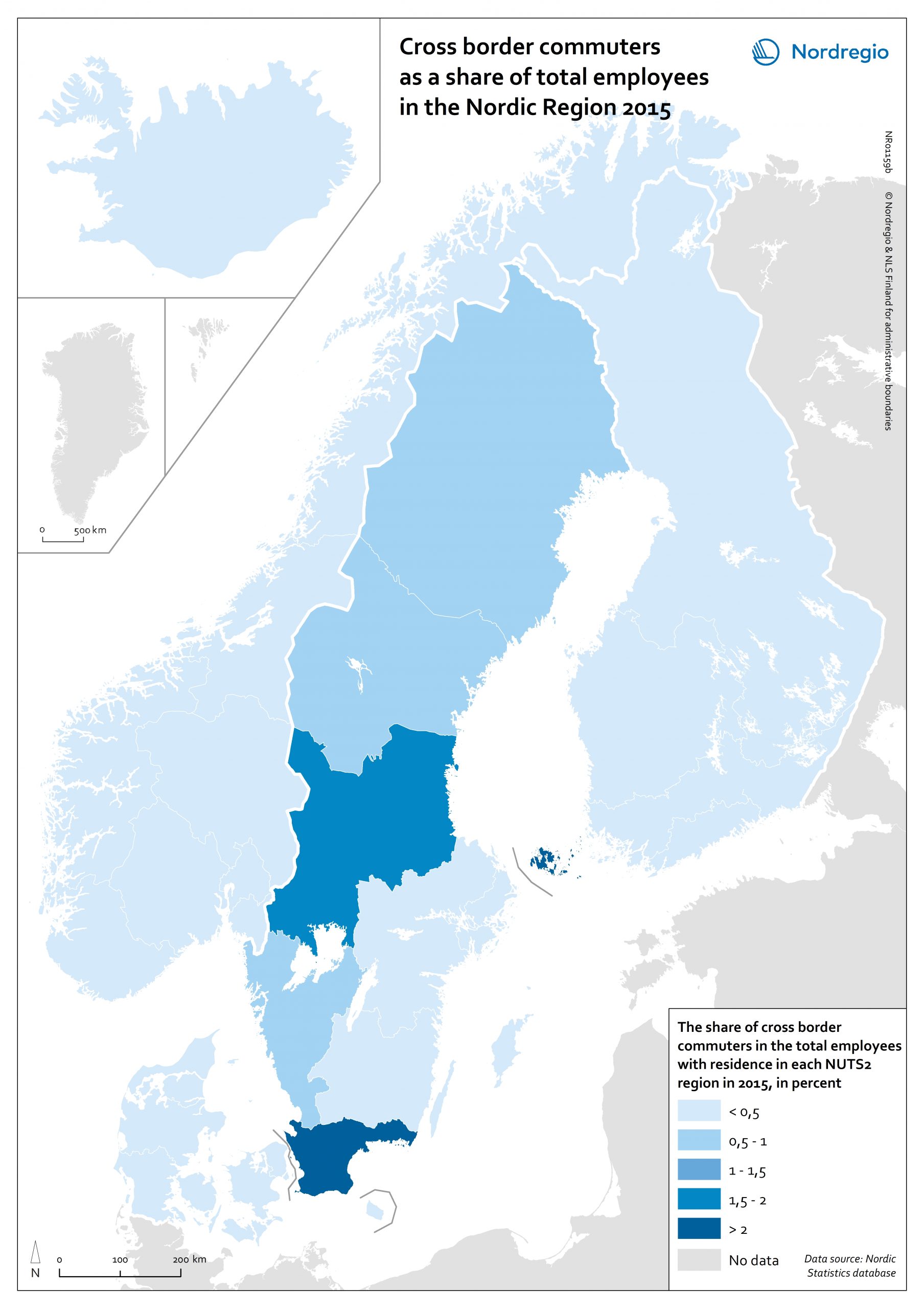

Labour market impacts of COVID-19

On May 17, 2020, 94% of the world’s workers were living in countries with some form of workplace closure measures in place (ILO, 2020). While it is too early to make predictions about the long-term consequences of this, it is possible to make some observations about the short-term labour market impacts in the Nordic Region. The map shows the number of people who registered as unemployed in April 2020 compared with the number of people who registered as unemployed in April 2019 at the municipal level for Denmark, Finland, Norway and Sweden and Åland Islands and at the national/territory level for Iceland and the Faroe Islands. The shading represents the increase in percent, with darker colours showing higher relative increases compared to the previous year and lighter colours lower relative increases. Municipalities shaded in blue on the map did not experience an increase in unemployment registrations in April 2020 compared to April 2019. Overall, the number of unemployment registrations across the Region was 38.9% higher in April 2020 than in April 2019. This increase equates to a total of 220 354 Nordic workers and has affected almost all Nordic municipalities and regions to some degree. Proportionally speaking, Norway saw the largest increase (69%), followed by Iceland (59%), Denmark (48%), Sweden (41%), and Finland (24%). Though between-municipality variation is evident, the greatest differences appears to be between countries. Interestingly, many Swedish municipalities along the southern coast between Sweden and Norway saw increases more consistent with the overall trend observed in Norway. This may be a reflection of the prevalence of cross-border commuting in these regions. It is important to note that the labour market situation in April 2019 has some baring on the results shown on the map. For example, the appearance of a sharper relative increase in Norway is primarily…

2020 October

- Economy

- Labour force

- Nordic Region

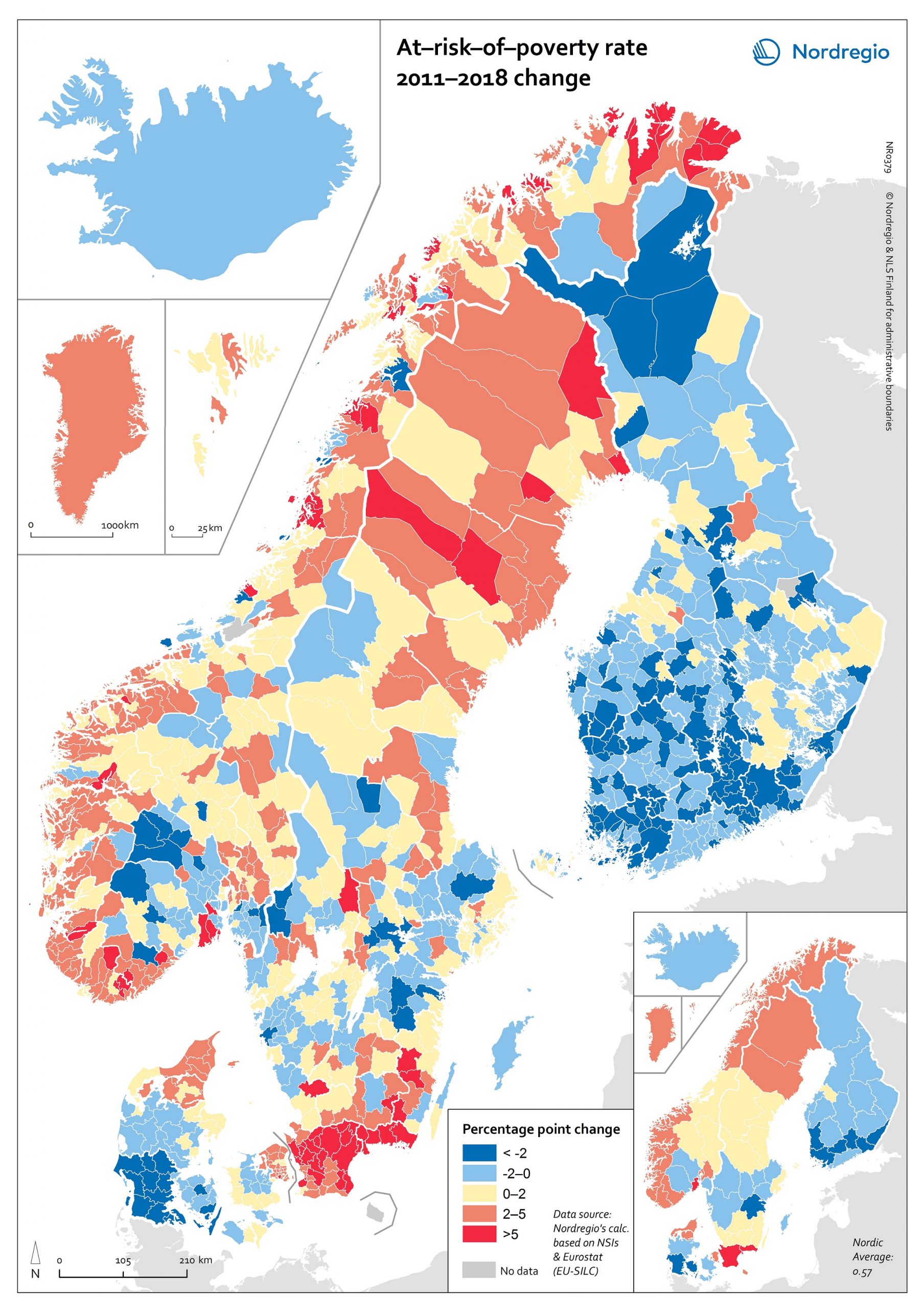

At-risk-of-poverty rate 2011-2018 change

The map shows the “at-risk-of-poverty” (AROP) rate in the Nordic Region. For the period from 2004 to 2018, the AROP rate increased in all Nordic countries except Iceland. This trend was strongest in Sweden. In Finland the AROP rate has been decreasing during the past few years, in line with what has previously been indicated – namely, on account of economic turmoil. This points to one of the weaknesses of using the AROP rate alongside several other measures of inequality. That is, while people have become poorer due to the economic crisis, the at-risk-of-poverty rate has paradoxically gone down. In addition, the AROP rate for Finland is higher in 2018 than it was in 2004. Looking at these trends on a regional level over a period of time (between 2011 and 2018), we can see that the AROP rate has decreased in almost all areas of Finland, whereas the pattern is rath er more varied in the other Nordic countries (we can also see a cohesive area in the south of Denmark where the AROP rate has decreased.) Again, Sweden has the most regions displaying increases in the AROP rate. Finland and Sweden contain the largest differences between the regions with the highest and lowest AROP rate. Hence the greatest regional differences are to be found in Sweden and Finland. Sweden also has the highest average AROP rate. About the At-risk-of-poverty The at-risk-of-poverty rate is a common measure of relative poverty and social inclusion. Most notably, it has been used for monitoring the EU2020 goal of inclusive growth. The at-risk-of-poverty rate is normally defined as “the share of people with an equivalised disposable income (after social transfer) below the at-risk-of-poverty threshold, which is set at 60% of the national median equivalised disposable income after social transfer.” (Eurostat). The indicator is…

2020 October

- Demography

- Economy

- Nordic Region